The ARR calculator created by iCalculator can be really useful for you to check the profitability of the past, present or future projects.

Rate of return calculator manual#

Using the ARR calculator can also help to validate your manual account calculations. Hence using a calculator helps you omit the possibility of error to almost zero and enable you to do quick and easy calculations. If your manual calculations go even the slightest bit wrong, your ARR calculation will be wrong and you may decide about an investment or loan based on the wrong information. If you choose to complete manual calculations to calculate the ARR it is important to pay attention to detail and keep your calculations accurate.

Calculating the accounting rate of return conventionally is a tiring task so using a calculator is preferred to manual estimation.

Rate of return calculator how to#

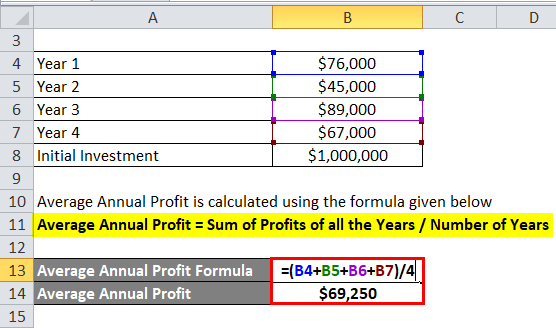

How to Calculate the Accounting Rate of Return (ARR)ĪRR for projections will give you an idea of how well your project has done or is going to do. Number of years - This refers to the duration of the project, for the duration it is expected to run.Final investment - The amount finally invested in the project.Initial investment - The basic initial cost of the project.Incremental expenses - It is defined as the main expenses that are going to be incurred while the project is running.Incremental revenue - This can also be defined as the revenue that you are going to generate every year.You just have to enter details as defined below into the calculator to get the ARR on any particular project running in your company. The ARR calculator makes your Accounting Rate of Return calculations easier. Why Use the Accounting Rate of Return (ARR) Calculator If the ARR is positive (equals or is more than the required rate of return) for a certain project it indicates profitability, if it's less, you can reject a project for it may attract loss on investment. Every investment one makes is generally expected to bring some kind of return, and the accounting rate of return can be defined as the measure to ascertain the profits we make on our investments. Whether it's a new project pitched by your team, a real estate investment, a piece of jewelry or an antique artifact, whatever you have invested in must turn out profitable to you. Calculating ARR or Accounting Rate of Return provides visibility of the interest you have actually earned on your investment the higher the ARR the higher the profitability of a project. The Accounting rate of return is used by businesses to measure the return on a project in terms of income, where income is not equivalent to cash flow because of other factors used in the computation of cash flow. Accounting Rate of Return, a Useful System for You to Make Profitable Investments Each formula used to calculate the accounting rate of return is now illustrated within the ARR calculator and each step or the calculations displayed so you can assess and compare against your own manual calculations. The Accounting Rate of Return (ARR) Calculator uses several accounting formulas to provide visability of how each financial figure is calculated.

Rate of return calculator free#

Please provide a rating, it takes seconds and helps us to keep this resource free for all to use Accounting Rate of Return (ARR) Calculator Results The Average Rate of Return is %Īverage Annualised Investment ( f) Formula and CalculationsĪccounting Rate of Return Profit Formula ( ARR 1) Formula and CalculationsĪccounting Rate of Return Standard Formula ( ARR 2) Formula and CalculationsĪccounting Rate of Return (ARR) Calculator Input Values and Calculated Amountsĭid you find the ARR Calculator and formulas useful? If so, it would be great if you could leave a rating below, it helps us to identify which tools and guides need additional support and/or resource, thank you.

0 kommentar(er)

0 kommentar(er)